Remember the issue of tariffs on European Union wine? When I last wrote about this in February, the United States Trade Representative (USTR) was threatening to expand them to Italian wine and up the rate to 100%. Ultimately, the tariffs stayed at 25% on “non-carbonated” wines under 14% ABV from France, Germany, Spain and England, and the threat of increasing or expanding them was merely deferred 180 days.

Well, guess what? The sand in that hourglass is once again running out. The threats are back on the table. And in the last 180 days, COVID-19 has ravaged the economy, particularly restaurants, where many of these wines are sold. Despite record retail sales on certain wines early in the pandemic, parts of the industry are truly upside down, and tariffs are a big part of that.

The USTR is set to review all of the tariffs assigned to the Boeing-Airbus dispute and decide by August 12 whether to increase them, substitute some of them with tariffs on different goods, or stay the course. Wine consumers like you and I have only until July 26 to speak up, and we need to. Not out of our own self-interest, but because of the damage these tariffs are doing to the companies and employees who bring us the wines we love. An increase in the tariffs would be wholly unacceptable.

The USTR is set to review all of the tariffs assigned to the Boeing-Airbus dispute and decide by August 12 whether to increase them, substitute some of them with tariffs on different goods, or stay the course. Wine consumers like you and I have only until July 26 to speak up, and we need to. Not out of our own self-interest, but because of the damage these tariffs are doing to the companies and employees who bring us the wines we love. An increase in the tariffs would be wholly unacceptable.

A recent Wine & Spirits Wholesalers of America (WSWA) study estimates that the U.S. alcohol industry will lose 92,570 jobs in 2020, which translates into $3.8 billion in lost wages, and $11 billion to the economy. What is more, the $363.3 million in tariff revenue that the U.S. federal government stands to gain from the tariffs will be washed out by $344.9 million in lost tax revenue. And that’s before any kind of federal bailout for the ailing industry.

“The COVID-19 crisis has been a challenge for everyone regardless of what you do, but especially for the restaurant industry,” notes Ben Aneff, President of the U.S. Wine Trade Alliance. “It has brought them to their knees. Because of that, many U.S. distributors have lost 50 to 60 percent of their sales. Which means these tariffs are that much more damaging. The very last thing they need as they are trying to get up off the mat is a government burden around their neck.”

But have these tariffs on wine done anything to move the European Union to reform its illegal subsidies for Airbus? Uh, no. Not one bit. (For more on that, go to the interview transcript below).

Aneff — who is also the Managing Partner of Tribeca Wine Merchants — has been actively rallying the industry and lobbying decision-makers in Washington D.C. on this issue for months. He took some time out of his busy schedule to talk to me about how the tariffs have combined with COVID-19 to create devastating consequences, what we can all do to urge repeal of the tariffs, and what comes next.

But First, Do Your Part

Unlike in January and February, you can now contact the U.S. Trade Representative as well as your elected officials in Congress via the US Wine Trade Alliance website. This is the simplest route to go, as they have recommended copy and talking points you can submit (and the USTR seemed to have made their formal submission form more complicated to fill out). I have also published my own letter to U.S. Trade Representative Robert Lighthizer to help give you further ideas on framing this argument. If you want to go the direct-to-the-USTR route, you can click the banner below for the official comment portal.

As an added step, place a call to your Representative in Congress as well as your Senators, especially if they are up for reelection like my senator is. When their staff hears from citizens, they hear from their staff. This is far and away the most effective way to put pressure on elected officials.

While you have them on the phone, you can ask for tariff relief for the industry, which has been provided to other industries impacted negatively by the several tariff spats going on with China.

And lastly, I highly recommend reading what Ben Aneff has to say in the transcript below. He is very well-spoken, reasonable, and has great insights on the mechanics of this situation. He did not go into wine to become a lobbyist. In fact, a year ago, he was simply managing his acclaimed wine shop in Manhattan. But he has risen to the occasion — alongside the entire group behind the newly formed U.S. Wine Trade Alliance — to protect their industry. And if that industry has given you half as much joy as it has given me over the years, then we owe it to them to help protect it and its hundreds of thousands of employees.

Interview with Ben Aneff

Opening a Bottle: When did you start seeing an impact from the 25% tariffs on European wine on your business?

Ben Aneff: You didn’t necessarily see it in October, November, December in large volume because quite a bit of the wine for fourth quarter had already been brought in. But starting in January and February you saw loads of items that were significantly more expensive, and now that we’re in the middle of summer, everyone has seen rosé [prices] sky-rocket. That’s a real problem. The issue is so all-encompassing. Whether you focus on fine and rare wine at the top of the market or you are a restaurant and you absolutely rely on high-quality, low-priced Sancerre or Spanish wine, 25% makes a tremendous difference. It is hard to understate that.

Twenty-five percent is a high enough mark that many importers are putting off buying certain products. Even if [those products] are critical to the overall health of the importer, the reality is that their cashflow does not necessarily allow them to take on this upfront cost.

What do wine consumers in America need to know about the present situation?

The current tariffs on the table are the World Trade Organization’s award stemming from the illegal subsidies to Airbus. This is not the digital services tax issue, which is separate. The “carousel date” for these current tariffs is August 12. That means, by August 12, effectively the USTR has to answer a series of questions: Should they raise the tariffs? Should they carousel off the tariffs [the mechanism to take a product off a tariff list and replace it with something else]? Should they lower the tariffs on certain products? The goal of the USTR here is to influence the EU to halt their illegal subsides to Airbus.

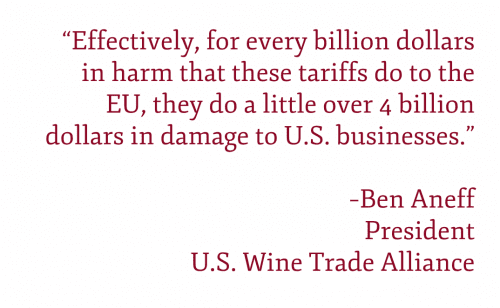

What they have to take into consideration is whether the tariffs disproportionately impact U.S. businesses. And in the case of the wine tariffs, there is absolutely no question. Effectively, for every billion dollars in harm that these tariffs do to the EU, they do a little over 4 billion dollars in damage to U.S. businesses. That not only makes these tariffs disproportionately damaging to American businesses, but it makes them particularly ineffective at influencing the EU.

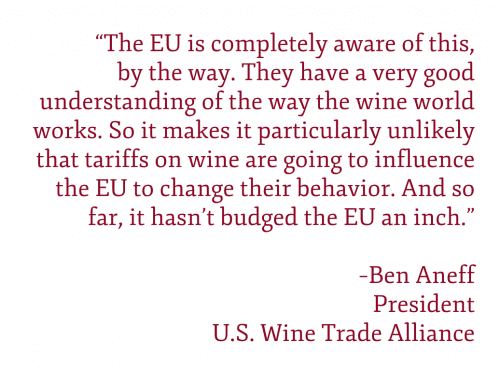

Certainly, in this case, the United States has an award from the WTO at $7.5 billion a year, and the USTR has a right [to levy these tariffs]. And it is a priority for Republicans and Democrats to stop the Airbus subsidies. The question is whether this is an effective way to do it. Without doubt, the least efficient way to tariff EU products is to put them on wine. You are damaging mostly small businesses in the U.S. The EU is completely aware of this, by the way. They have a very good understanding of the way the wine world works. So it makes it particularly unlikely that tariffs on wine are going to influence the EU to change their behavior. And so far, it hasn’t budged the EU an inch.

Certainly, in this case, the United States has an award from the WTO at $7.5 billion a year, and the USTR has a right [to levy these tariffs]. And it is a priority for Republicans and Democrats to stop the Airbus subsidies. The question is whether this is an effective way to do it. Without doubt, the least efficient way to tariff EU products is to put them on wine. You are damaging mostly small businesses in the U.S. The EU is completely aware of this, by the way. They have a very good understanding of the way the wine world works. So it makes it particularly unlikely that tariffs on wine are going to influence the EU to change their behavior. And so far, it hasn’t budged the EU an inch.

Have you heard anecdotally from winemakers in the European Union about whether this has hurt them in any way? Or have they simply shifted their wines to other markets?

It’s sort of two fold. One, they don’t think they have the political pull to do anything about it. Which I think is correct. In the United States, we think of the agriculture industry as a huge, massive political machine, but the wine industry over there doesn’t have the political pull that we think they do. A lot of the larger owners of wine businesses in Europe have a lot of other interests. Wine might be secondary or even tertiary to them.

But to your point, any producer that you would recognize has a lot of growing markets overseas. They’ve been building those markets for a very long time. And the great historic wine regions of Europe cannot easily increase supply. So if you are building a new market, you are taking from one bucket and putting it into another bucket.

This is one of innumerable ways that tariffs on wine are a bad idea. They don’t influence the EU for a wide variety of reasons.

What is the alternative then? Is there an official stance from the U.S. Wine Trade Alliance on where these tariffs should be directed instead? Because, I hate to say it, but if they just increase them on Airbus and Airbus subsidies, won’t that hurt the U.S. airline industry, which is reeling from COVID-19 as well?

That’s a really great question. I’m not a trade lawyer, but I can tell you that Boeing, in their comments to the U.S. Trade Representative in January suggested that a whole range of Airbus products, the purchase agreements for those, are through Airbus’ subsidiaries here in the U.S. And the contracts most likely have delivered prices. So the brunt of the damage from those tariffs would be borne by the subsidiaries to Airbus here in the U.S., and wouldn’t easily be able to be passed on to U.S. airlines.

And those subsidiaries are European owned?

Exactly right.

Then how would that not trickle over to a U.S. airline that runs on Airbus planes?

If you are American Airlines and your contract is through Airbus Subsidiary A, you have a delivered price. Again, I’ll specify that I am not a trade lawyer, but I will tell you that Boeing very specifically recommended this in their comments to the U.S. Trade Representative. You can’t say that no U.S. businesses or no one in the U.S. wouldn’t have any damage sown to them — for instance, the Airbus subsidiaries have employees here in the U.S. — but at the very least, you could keep the damage to companies that are owned by European entities. Whereas in the wine world, 4-to-1 damage hits U.S. retailers, U.S. distributors, U.S. importers.

The other thing is that there are a whole range of industries where government regulation doesn’t require the tariffs to hit them so hard. In the wine industry, we are so highly regulated, we don’t have the capacity to shift business models to help mitigate the damage from these tariffs. For instance, take a wine importer in the U.S. It’s not just a business model, but they are not allowed to import any other product besides wine and spirits, and maybe glassware. So it is not like they can pick up the ball and say “you know what? Instead of just wine, since we are being slammed with wine tariffs, we’re going to start importing a whole range of other products from other countries.” The U.S. Government says “No, no, no. You have an alcohol license. That means we get to regulate you in a way that we cannot regulate effectively anything else.” Another example is a grocery distributor who might be able to bring in 50,000 SKUs. Tariffs on a small percentage of that might not hit [the grocery distributor] as hard.

Of course, to change all of that, you could choose which way is easier: getting 50 separate states to pass different state alcohol regulations, or create a new amendment to the Constitution.

Yeah, that’s real easy.

[Laughing]. I don’t know which one is preferable. I’m going to take a nap before I get involved.

Final political question, I promise. What if in August we get another ‘stay of execution’ and Biden gets elected … would there be a big shift in policy?

I will say this, particularly with the WTO award: the Airbus issue is a priority for both Democrats and Republicans. Boeing is a key part of the U.S. economy. It is America’s largest exporter, it is in a Democratic state [Washington]. Bringing this issue to resolution will be a priority to both Republican and Democratic administrations. So our job is to help them understand why putting tariffs on wine is a really ineffective way to bring about that resolution.

If there were 3-5 easy steps that consumers could take to make their voice be heard, what would those be?

You are going to want to write to your Senators and Congressperson. (You can do that via the U.S. Wine Trade Alliance website). Urge them to contact the USTR, Robert Lighthizer, and ask that he “carousel off” tariffs on wine and put them on something less damaging to U.S. businesses. And they should also ask for tariff relief for these small businesses. Congress has within its power to help a lot of these struggling businesses.

They’ve done that for farmers in the past, correct?

Absolutely, and now is the right time for it, particularly with the COVID-19 crisis and how the restaurant industry and all of the suppliers of the restaurant industry have been so absolutely devastated by this crisis. This is sound policy. You inject cashflow into struggling businesses who are reeling because of the effects of COVID-19.

And, without a doubt, they should contact the USTR. They should go to the official comment portal on this issue and ask the USTR to scrap the tariffs on wine because they are too damaging to U.S. businesses and they are not effective at influencing the EU.

People in Congress are beginning to grasp this issue. They now know that tariffs on wine do not just effect people in one state. It’s not just one giant business in New York City or one giant business in San Francisco. This effects small businesses in all 50 states. You probably know someone who is being really hurt by these tariffs. They are starting to have a real understanding of that. And they really value when their constituents tell them how these tariffs impact them and their businesses.

And if you are a member of the wine trade, come to our website and sign up. It doesn’t cost you anything, and we have regular emails with detailed information on who to contact and many of the best arguments to make and the like.